Beyond the upcoming Fusaka upgrade slated for early next month, the Ethereum network shows no signs of slowing down its development pace. Vitalik Buterin, the co-founder of Ethereum, has recently unveiled a massive network scaling roadmap for 2026, with the core objectives being to challenge competitors directly on “speed” and “cost.”

🎯 “Targeted Growth” Vision: Gas Limit to Increase 5x

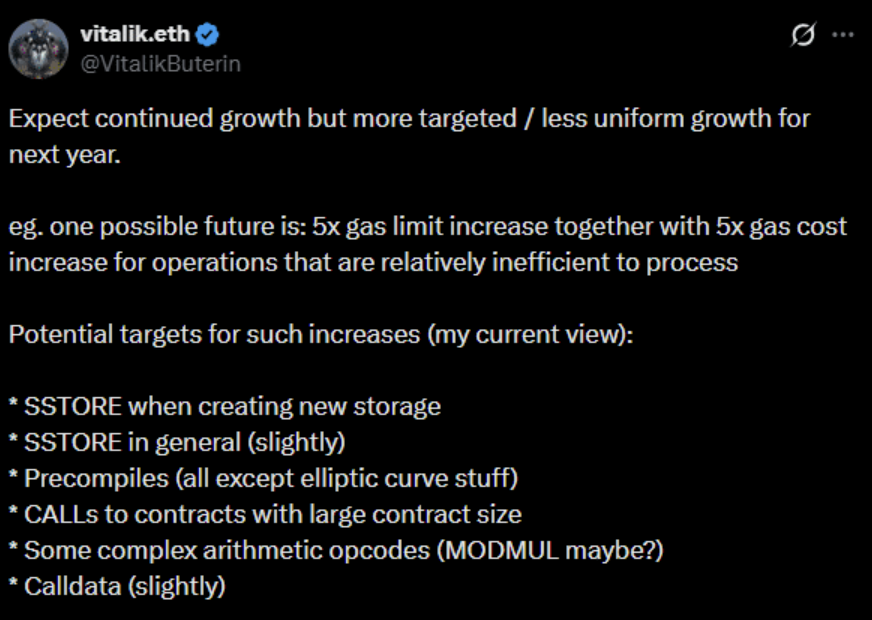

On November 26, Vitalik Buterin disclosed his vision for “Targeted Growth,” aiming to increase the network’s Gas Limit by up to 5 times within the next year. This is considered a critical maneuver to directly confront rivals on speed and transaction costs.

Increasing the Gas Limit is analogous to expanding the block’s data pipeline, enabling the network to process a significantly higher number of transactions per second in each block. The expected outcomes are:

Massively Increased Ethereum Throughput: Supporting higher network activity and transaction volume.

Further Suppression of Layer 2 Fees: Making the overall Ethereum Ecosystem significantly more cost-effective.

However, Vitalik cautioned that heavy and inefficient operations will come with higher transaction costs, a measure designed to prevent network Nodes from being excessively burdened with data storage.

⚔️ Accelerating Development to Maintain Smart Contract Supremacy

Currently (as of November 2025), Ethereum’s Gas Limit stands at 60 million units per block, already double the level of the previous year. This confirms Ethereum’s continuous acceleration mode.

The critical question is why Ethereum is aggressively scaling its network. The answer lies in the need to catch up and maintain its Smart Contract throne against Solana and other Layer 1 networks.

The Solana Challenge: While Ethereum enjoys long-tested institutional trust and superior decentralization, Solana has established a strong niche as the cheapest and fastest chain, particularly during the Memecoin Supercycle, attracting retail traders with minimal capital, an area where Ethereum once suffered from sky-high fees.

Closing the Gap: In 2024, Ethereum’s average transaction fee dropped to about $5, and by 2025, thanks to the Pectra upgrade, fees fell below $1. Although the current fee of approximately $0.31 is still higher than Solana’s $0.0022, Vitalik's 5x Gas Limit plan for 2026 is expected to be the key to closing this gap in both cost and speed.